Let’s work together to find a solution

Rely on AVANA Capital to help preserve your wealth and create growth for your business.

Benchmark borrowing costs in the United States are now at the highest rate in over 22 years. In efforts to tame inflation, the Fed has created a unique lending environment that is squeezing out traditional banks. In turn, it’s also providing a unique opportunity in private credit that hasn’t been seen in decades.

Given the current market conditions, there is an increased strain and instability for traditional lenders, as they fear a potential liquidity squeeze. In response, banks are retreating and tightening their lending standards as a way to write fewer loans for less exposure. That means that now even well-qualified loan applicants with high credit scores and a solid financial standing are being turned away by more traditional borrowing avenues.

Private credit is now a beacon of light guiding those borrowers to the more versatile funding opportunities provided by private lenders. In turn, it also creates wise investment opportunities for individuals with the money/capital to help fund the loans.

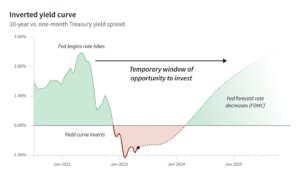

The above graph demonstrates the current inverted yield curve, and in simple terms – it is now more expensive to borrow funds for 30 days than for 30 years. This creates conditions that are favorable to private lenders, where potential borrowers are paying higher interest rates even for short-term investments.

In other words, private lenders can capitalize on this changing and temporary environment that has created a growing demand for alternative lenders and higher rates of return to fill in this gap in the market.

All in all, there is currently a lucrative and strategic opportunity for risk-adjusted returns in private credit until market conditions normalize. Indicators are showing this opportunity will last only until early 2024.

Private credit, or private lending, is an asset class that includes loans, investments, fixed income and other structured financial instruments. Private lending is particularly attractive to investors because it’s characterized by higher yields at lower overall risk when compared to equities.

Private lenders partner with investors to fund loans for borrowers – very similar to traditional banks. This type of lending is most commonly done to secure commercial real estate properties and other types of assets that require a more customized capital solution than those provided by traditional banks.

One of the key differences is private lenders can charge higher interest rates as decisioning is swift. Thus, borrowers make the trade-off between higher borrowing costs and more flexible terms, resulting in an attractive return for the investor who is willing to loan out their capital.

Though the current opportunities in private credit are appealing to savvy investors, finding the right partner is critical. At AVANA Companies, our unique approach to commercial real estate lending makes us a leading destination for investors who want to cash in on our elevated returns paid in the form of predictable monthly payments.

Sundip Patel, our Co-Founder and CEO, explains why partnering with AVANA for private credit opportunities is so attractive to cautious investors: “We put our own money in on the deals. We’re motivated, just like our investors, to make prudent lending decisions. This is very unique to AVANA Companies.”

Since our private credit investment opportunities stem from commercial real estate debt that our team originated, we have a personal stake in the game and have performed rigorous due diligence to pursue only the most favorable loans. At present, we focus on low-leverage commercial debt that offsets the risk that is present in the current environment.

So even amid the ongoing market instability, working with a trusted and experienced partner like AVANA Companies gives investors the confidence and reliability they need to earn predictable monthly returns.

As one of our investors puts it: “I sleep better at night knowing that the team at AVANA is taking the same risk with me.”

As shown in the graph above, the window of opportunity is short, so make your money work for you today. Connect with AVANA Companies to learn more about the benefits of Private Credit Investments.

AVANA Companies is a comprehensive impact private lending and fractional investment asset management platform serving entrepreneurs and investors. Comprised of a dedicated and diverse team with a unified mission – to create jobs, stimulate economies and contribute to clean energy – AVANA’s Family of Companies is focused on supporting American businesses and providing impactful, socially-driven investment opportunities that preserve wealth and create growth.

Contact us today to learn more.